Create. Send. Get Paid.

Invoicing, Quotes, Payments

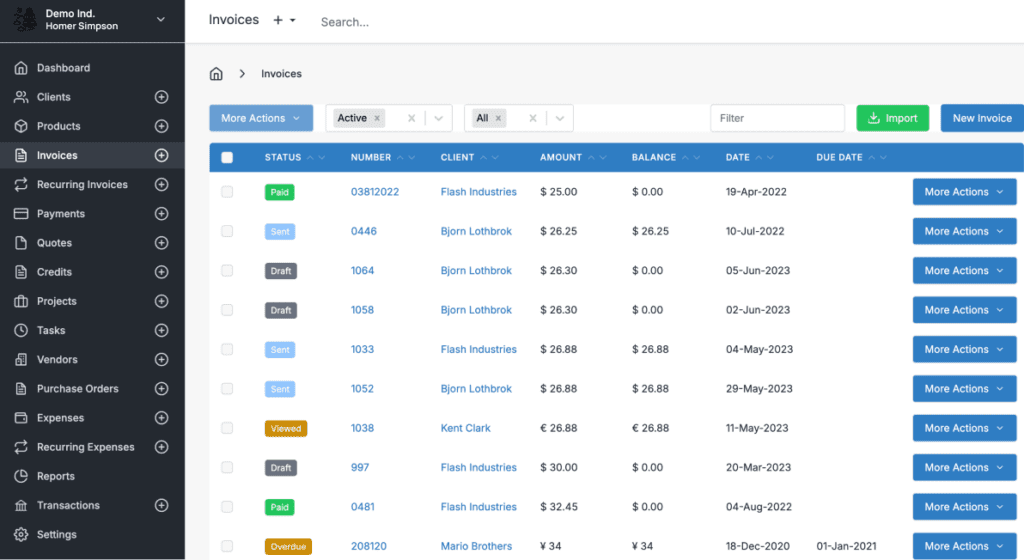

Invoicing & Quotations

- Create clients and send invoices in seconds

- Create recurring invoices, client payment profiles

- Send invoices via Gmail, MSN, or custom SMTP

- Product library tool populates invoices & quotes

- Attach 3rd party files to client invoices & emails

- Reporting, Accounts Aging, Client Statements

- Accept credit cards, ACH payments, PayPal, & more

- Clients pay directly from their invoice with the click of a button

- Receive app and email notifications when clients view

- View instant data updates when payments are made

- Automate payment reminders & past due notifications

Get Paid Faster

Invoicing & Payments Features

Create & Email Invoices & Quotes in Real-Time

Real-time PDF preview creation shows your invoice review as you build it in real-time.

Upload your Company Logo

Upload your logo & customize invoice colors to match your brand!

Stripe, PayPal, Checkout, Braintree, PayFast, Authorize, Square, Mollie and more!

Dynamic Dashboard Data

View revenue, invoices sent, recent activity data. Track upcoming invoices, invoices past due, and more!

4 free invoice templates, Pro members have 10 professional designs!

Track Inventory Levels

Set inventory levels per product. Inventory levels are reduced automatically as products are invoiced.

Additional Users & Set Permissions

Add users and set access permissions per user. Users can belong to multiple companies.

Link Multiple Companies (x10) with 1 Login

Manage invoicing for up to 10 business accounts all under one Invoice Ninja account.

Recurring Invoicing & Auto-Billing Clients

Save time by automatically billing long-term clients with recurring invoices.

Attach 3rd Party Files to Invoices & Expenses

Combine important files with your invoice document. All in one email delivery.

Customize Invoice Fields

Create dynamic custom fields for your company, client details, invoice product columns, more!

Client-Side Account Portal

Client can view their invoices, quotes, payments, documents, and all transaction history.

Log every task. Record every second. Then simply click to add the data to your invoice.

Send Invoices & Quotes via Gmail & MSN Accounts

The most requested feature by far! Email invoices, quotes, & payment reminders via your Gmail or MSN email!

Email invoices, quotes, & payments emails via your own SMTP server configuration to provide your clients a 100% branded experience

Create Group Workflow Settings

Create 'groups' of custom settings: payment terms, designs and more, for different "groups" of clients.

Custom Domain 'Billing.YourCompany.com'

Simply create a unique DNS A Record entry and we’ll work some magic!

Organize and plan your client work with our visual project management tool.

Approved Quotes Auto-Convert to Payable Invoices

Turn an approved quote into an invoice with just one click of a button or allow auto-conversion from client approval.

Fully Customizable Invoice Template Design

Match the look of your invoice with the design of your brand.

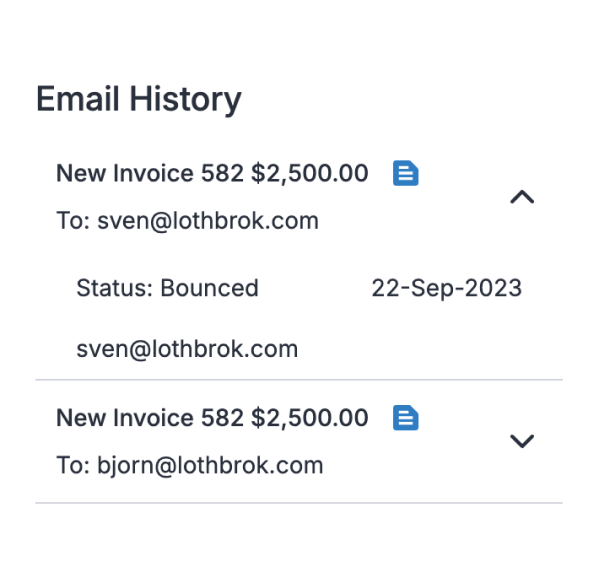

Customize Email Subjects & Body Text

Tailor your invoice email text for improved open rates and brand recognition.

Accept Deposits & Partial Payments

Request partial payments using the same invoice again and again.

Invoice Payment Auto-Reminder Emails

Use a pre-written auto-reminder email sequence to remind clients your invoice needs to be paid.

Alerts When Client Views & Pays Invoices

Receive notifications when a client views and pays your invoice.

Enable Invoice Approval Checkbox or Client Signature

Ensure clients understand your terms of agreement prior to payments.

Item & Product Library System

Quickly select from potentially thousands of predefined service and product descriptions.

Bulk Emailing Invoices & Quotations

Save time by quickly selecting multiple invoices and emailing them out together.

Create Reports, Accounts Aging & Client Statements

Understand the bigger financial picture with our advanced report features.

Automatically import your expenses data to your Invoice Ninja account.

Multiple Currencies & Languages

Dozens of languages & currencies – a true solution for global payments.

Currency Formatting '.' vs ','

Set 100.00,00 or 100,00.00 per your region

Setup Automatic Credit Card Gateway Fees

Automatically add percentage fees to select predetermined price ranges.

Setup Automatic Late Fees on Unpaid Invoices

Bill a client extra for unpaid invoices with automatic late payment fees.

Enable/Disable Recurring When Cloning

Clone recurring invoices to a regular invoice, and vice versa!

Set a ‘BCC’ Address for Invoice & Quote Emails

Include additional company members in notifications.

Tax Settings per Line Item or Invoice Total

Inclusive taxation, excusive taxation, line-item taxation, and more!

Enabling/Disabling Nav Modules

Show more or less menu navigation based on your work preference.

Create Custom Payment Instructions

Special payment instructions? Create custom instructions directly in the invoice!

Automated Currency Exchange

Automate currency exchange between clients currency, and your account default currency.

Auto Sales Tax Calculation

Automate your invoice sales tax calculation (US States).

Let's Connect!

Connect with thousands of Invoice Ninja users on our community forums.